Credit Union Marketing: Differentiating Your Credit Union from Banks

What makes your credit union different from your competitor down the road? From our experience in branding and marketing financial institutions, we can attest this question doesn’t often have an easy answer. In fact, in a market as highly saturated as the financial industry, standing out may be the toughest challenge you can take on. It can also be one of the most rewarding.

Credit unions are in a unique position in that they not only compete with other credit unions for market share, but must also beat out big banks for business. While leveraging lower home and auto loan rates to acquire members used to be a tried and true strategy for smaller, local credit unions, competing on price and products is no longer a viable option. Instead, institutions big and small alike, must dig deep to find differences—no matter how subtle—that set them apart in the eyes of current and potential members.

How Consumers Perceive Banks vs. Credit Unions

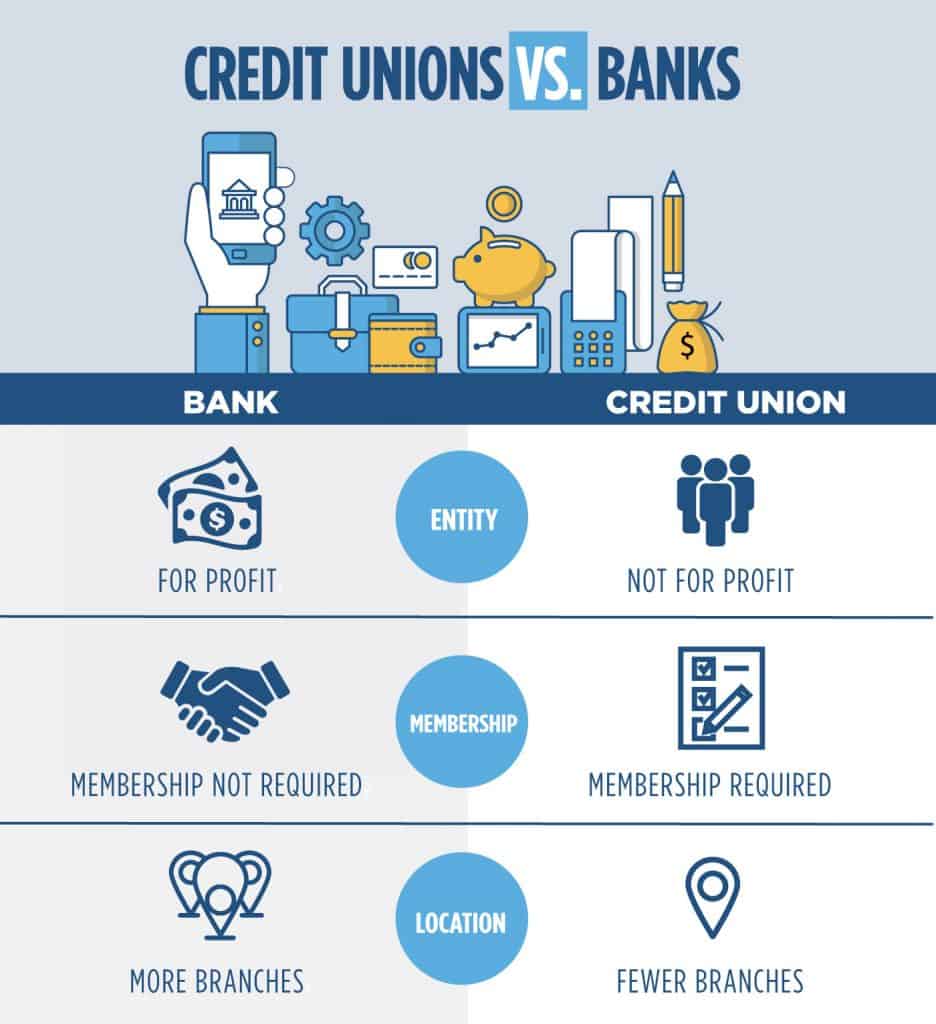

Here’s the truth, many consumers don’t know the difference between a bank and a credit union. And while asking Google to spell out those differences offers 51.4 million results, consumer perception still favors big banks for serious financial service, with credit union definitions murky at best.

In fact, research from CUNA revealed consumer confusion around one of the most widely used terms in the credit union world—member. Credit unions often pride themselves on the perks that come with membership, but it seems this marketing method has created the perception of a barrier to entry into this “exclusive” club.

Another area prone to misconception is banking technology. According to a Raddon study, although described as “greedy and impersonal,” big banks score 15% higher with consumers when it comes to offering the latest technologies. The kicker? Most credit unions do offer mobile and online applications, however, consumers still believe them to trail big banks in that respect.

So how can credit unions combat skewed consumer perceptions and stand out in the marketplace? Differentiation can involve deep introspection, but often, the answer lies with those who know your brand best—the ones whose lives it impacts.

How to Differentiate Your Credit Union

Having worked with credit unions working towards that exact aim, we’ve learned round-table meetings with executives can only get you so far. While internal insights can be a useful starting point, hearing from real members, branch employees and the community as a whole is invaluable.

There are a number of ways to gather that intel, but here’s a quick breakdown of the ones we’ve found most effective.

Ask for member and staff feedback

You know your brand better than anyone else. But your members and staff know your actions. And, as we’re all aware, actions speak louder than even the most meticulously researched and artfully crafted branding.

If you want to know how your credit union is perceived, and what your members and staff believe you do better than anyone else, just ask.

Focus groups and interviews are a popular way to gather large amounts of member feedback. But extracting nuggets of information from audiences not used to speaking on record about their everyday banking experiences is easier said than done. In both group and one-on-one settings, creating a comfortable environment is key—you’ll need a knowledgeable and likeable moderator; specific, open-ended questions; and a goal in mind.

Map out member journeys

Gathering feedback lets you know what your members think about your institution. Mapping the experiences that led to those conclusions gives you a more in-depth understanding of what your members truly value about your brand and why they’ve placed their trust in your credit union.

Cheryl Parker, evok’s director of client services adds, “charting member interactions with your institution—including motives, attitudes and outcomes—gives you a glimpse at how the relationship with your members evolves. Spotting patterns in member journeys can help you predict where a member might be headed. With these insights, your staff should be able to anticipate their needs and remain ready to offer useful suggestions to help them advance towards their goals.

Most importantly, a deeper look at how your credit union actually serves its members may help you identify the missing piece in your differentiation puzzle.”

Spend some time in the frontlines

Your office at HQ offers a quality vantage point for big-picture thinking. But getting down in the trenches may be the change of scenery you need to complete your vision.

Pay a visit to your branches, attend community events hosted or sponsored by your institution, get a first-hand look at the impact your institution makes in the areas you serve. This in-person, in-environment research offers a fresh perspective and differs from feedback gathered from focus groups and member testimonials in that you’ll be interacting with members and staff on their turf.

Do your tellers know the name of nearly every person who walks through the door? Are members coming into your branches to submit payments that could be handled via online banking? Take the time to educate folks about your digital offerings if your member is interested.

Translating Your Unique Points into Marketing Propositions

Identifying these points of difference, particularly when they are subtle from your institution to the next, can be tricky at best. Sometimes, it’s best to call in the pros and hire an ad agency experienced in credit union marketing. Regardless of the route you choose to take, there is no time to waste when it comes to setting your financial institution apart from those competing for your market share.

Searching for more credit union marketing know-how? Don’t miss our latest State of the Industry report, which includes an overlook at trends and our predictions for what’s next for credit unions when it comes to marketing.